If you’ve been thinking about it, 2025 is the perfect time to buy crypto. Why? Because there are now more secure, beginner-friendly options than ever. Whether you’re a complete newbie or someone with a few trades under your belt, getting started has never been this simple.

Today’s top cryptocurrency exchanges offer faster transactions, better security, and easier ways to fund your account. Plus, identity verification is smoother, and most platforms now support multiple payment methods like bank transfers, cards, and even PayPal.

In this guide, I’ll walk you through everything you need to know to buy crypto safely and confidently in 2025. You’ll discover the top 7 platforms for fast, secure purchases, learn how to set up your account, and get pro tips for making your first crypto purchase without stress.

We’ll also cover why choosing a regulated, trusted platform matters more than ever. Not all crypto trading platforms are created equal. Some offer airtight security, while others fall short. This guide will help you spot the difference and pick what works for you.

Ready to dive in? Let’s get you set up to buy crypto the smart way in 2025.

Why Choosing the Right Platform to Buy Crypto Matters

When it comes to your money, where you buy matters. Picking the wrong platform to buy crypto can lead to costly mistakes. You might face high fees, slow withdrawals, or even risk losing your funds to poor security.

Some platforms look flashy but don’t protect your assets well. Others might delay payments or make it tough to withdraw your crypto when you need it most. That’s why it’s so important to choose wisely, especially in 2025 when new platforms seem to pop up daily.

A great crypto trading platform should offer four key things:

- Low Fees: Hidden charges can eat into your profits fast. Look for clear, competitive pricing.

- Strong Crypto Security: Features like two-factor authentication (2FA), cold storage, and insured wallets keep your assets safe.

- Fast Payments: Quick deposits and withdrawals mean you can trade or cash out without long waits.

- Easy Identity Verification: The best platforms offer a smooth, fast KYC (Know Your Customer) process.

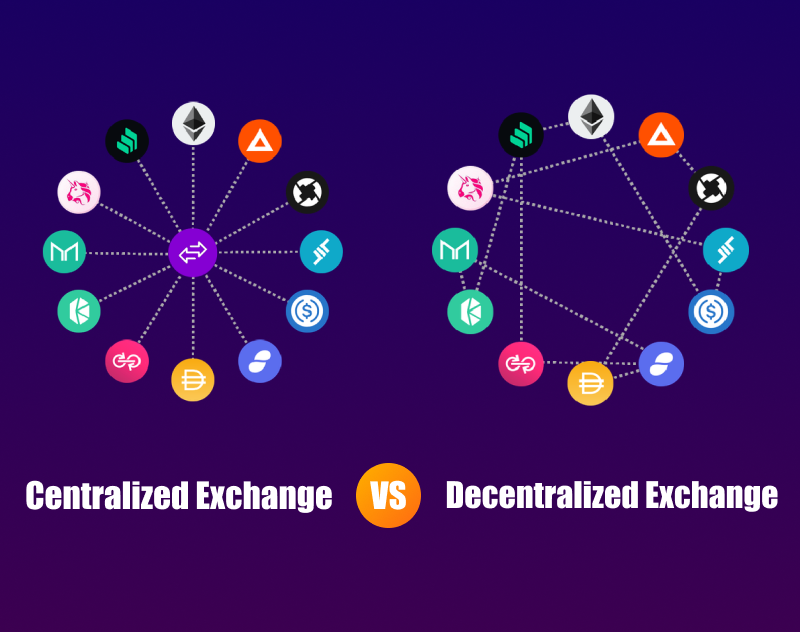

You’ll also want to decide between centralized exchanges (CEX) and decentralized exchanges (DEX). CEX platforms like Coinbase or Binance are regulated and beginner-friendly. DEX options like Uniswap offer privacy but can be tricky for newcomers.

Don’t worry — I’ll break this down for you in detail later. For now, just know your choice of platform shapes your entire crypto experience. And in a market as fast-moving as crypto, you want a platform you can trust.

Top 7 Platforms to Buy Crypto in 2025

Ready to find the right place to buy crypto this year? I’ve rounded up the best, safest, and fastest platforms for you. Each one offers unique features to match your trading style and experience level. Let’s break them down.

Coinbase – Best for Beginners

Coinbase is the easiest way to buy crypto if you’re just getting started. It’s user-friendly, secure, and fully regulated.

Trading Fees: 1.49% for standard buys; lower with Coinbase Advanced.

Payment Methods: Bank transfer, debit/credit cards, PayPal (for US users).

Security Features: 98% of funds in cold storage, insurance for digital assets, 2FA.

Pros:

✅ Super easy to navigate

✅ Trusted, regulated US-based platform

✅ Great educational content for beginners

Cons:

❌ Higher fees compared to other platforms

❌ Limited altcoin selection

Binance – Best for Low Fees and Trading Volume

Binance is a powerhouse for active traders who want to buy crypto without hefty fees.

Trading Fees: 0.1% per trade; discounts for using BNB.

Payment Methods: Bank transfer, cards, peer-to-peer, third-party apps.

Security Features: SAFU insurance fund, 2FA, cold storage for most funds.

Pros:

✅ Lowest fees on the market

✅ Huge selection of cryptocurrencies

✅ Massive daily trading volume

Cons:

❌ Can be overwhelming for new users

❌ Limited availability in some countries

Kraken – Best for Security and Regulatory Compliance

If top-tier security is your priority, Kraken is one of the best places to buy crypto in 2025.

Trading Fees: 0.16% maker / 0.26% taker fees.

Payment Methods: Bank wire, SWIFT, FedWire, crypto deposits.

Security Features: Offline cold storage, 2FA, proof-of-reserves audits.

Pros:

✅ Best-in-class security reputation

✅ Licensed in multiple jurisdictions

✅ Excellent customer support

Cons:

❌ Slower verification process

❌ User interface feels dated

Crypto.com – Best Mobile App for Beginners

If you want to buy crypto on the go, Crypto.com offers a sleek mobile app with tons of features.

Trading Fees: 0.075%–0.15% with discounts for staking CRO.

Payment Methods: Bank transfer, credit/debit cards, PayPal (select markets).

Security Features: Cold storage, insurance coverage, biometric logins.

Pros:

✅ Intuitive mobile app

✅ Wide range of cryptocurrencies

✅ Cashback Visa card available

Cons:

❌ Customer support can be slow

❌ Some features locked behind staking

Gemini – Best for Insured, Regulated Crypto Security

Gemini makes it simple to buy crypto while enjoying institutional-grade security.

Trading Fees: 1.49% transaction fee + spread.

Payment Methods: Bank transfers, cards, wire transfers.

Security Features: 2FA, cold storage, digital asset insurance.

Pros:

✅ US-regulated and insured

✅ Highly secure with a clean interface

✅ Reliable for both small and large buys

Cons:

❌ Higher fees than competitors

❌ Fewer advanced trading features

KuCoin – Best for Altcoin Selection and Trading Tools

Looking to buy crypto beyond Bitcoin and Ethereum? KuCoin is your go-to for altcoins.

Trading Fees: 0.1% per trade.

Payment Methods: Crypto deposits, peer-to-peer, third-party providers.

Security Features: Cold storage, internal risk management, 2FA.

Pros:

✅ Massive selection of altcoins

✅ Advanced trading tools and bots

✅ Low trading fees

Cons:

❌ Not licensed in the US

❌ Limited fiat deposit options

Robinhood Crypto – Best for Quick, No-Fee Small Purchases

If you want to buy crypto quickly and without fees, Robinhood Crypto is a solid pick.

Trading Fees: Zero trading fees.

Payment Methods: Bank transfer.

Security Features: 2FA, insurance for cash balances.

Pros:

✅ No commissions on crypto trades

✅ Simple, beginner-friendly interface

✅ Fast account setup

Cons:

❌ Limited cryptocurrency selection

❌ You can’t withdraw crypto to external wallets

Now you know the best places to buy crypto in 2025, whether you’re a cautious beginner or an eager trader. In the next section, I’ll show you how to set up your account and verify your identity on these platforms with ease.

Comparing Platforms — Fees, Payment Methods, and Security

Before you decide where to buy crypto, it’s smart to compare what each platform actually offers. Fees, payment options, and security features can make a big difference in your crypto experience. Here’s a clear breakdown to help you pick the right fit.

Fees Comparison

- Coinbase: 1.49% per transaction (higher for cards)

- Binance: 0.1% trading fee (discount with BNB)

- Kraken: 0.16% maker / 0.26% taker

- Crypto.com: 0.075%–0.15% (lower if staking CRO)

- Gemini: 1.49% transaction fee + spread

- KuCoin: 0.1% per trade

- Robinhood Crypto: No trading fees

💡 Best for Low-Fee Crypto Buys: Binance, KuCoin, and Crypto.com

💳 Supported Payment Methods

- Coinbase: Bank transfer, credit/debit cards, PayPal

- Binance: Bank transfer, credit/debit cards, peer-to-peer, third-party apps

- Kraken: Bank wire, crypto deposits, FedWire, SWIFT

- Crypto.com: Bank transfer, cards, PayPal (select regions)

- Gemini: Bank transfers, credit/debit cards, wire transfers

- KuCoin: Crypto deposits, peer-to-peer, third-party services

- Robinhood Crypto: Bank transfer

💡 Fastest Payment Options: Coinbase, Binance, and Crypto.com

🔐 Security Features

- Coinbase: 98% cold storage, insurance, 2FA

- Binance: SAFU fund, 2FA, cold storage

- Kraken: Offline storage, 2FA, proof-of-reserves audits

- Crypto.com: Cold storage, insurance, biometric login

- Gemini: Cold storage, digital asset insurance, 2FA

- KuCoin: Cold storage, internal risk controls, 2FA

- Robinhood Crypto: 2FA, insurance for cash balances

💡 Most Secure Crypto Platforms: Kraken, Gemini, and Coinbase

This quick comparison makes it easier to see where each platform shines. Whether you want to buy crypto with the lowest fees or prioritize top-notch security, now you can choose with confidence. Up next — I’ll walk you through setting up your account and verifying your identity, step by step.

Step-by-Step Guide to Setting Up Your Crypto Account

Ready to buy crypto for the first time or switch to a new platform? Here’s a beginner-friendly walkthrough to help you set up your account safely and quickly.

1️⃣ Choose Your Platform

Pick a trusted, regulated exchange that fits your needs. If you’re new, Coinbase is a great starter. For low fees, Binance works well.

💡 Pro Tip: Always compare fees, payment options, and security before you decide where to buy crypto.

2️⃣ Create Your Account

Head to your chosen platform’s website or app. Click Sign Up and fill in your details — email, password, and country of residence.

Use a strong, unique password you don’t use elsewhere.

3️⃣ Complete Identity Verification (KYC)

Most exchanges require Know Your Customer (KYC) to protect against fraud. It sounds fancy but it’s simple.

You’ll need to upload:

- A government-issued ID

- A clear selfie

- Proof of address (like a bank statement or utility bill)

This keeps your account safe and lets you buy crypto without limits.

4️⃣ Activate 2FA for Added Security

Always turn on two-factor authentication (2FA). It’s an extra safety step that sends a code to your phone or authenticator app when you log in or withdraw funds.

Trust us — this small step protects your crypto wallet from hackers.

5️⃣ Fund Your Account

Next, add money so you can buy crypto. Choose your preferred payment method: bank transfer, credit card, or PayPal (if available).

Bank transfers are usually cheaper, while cards are faster.

Bonus Tip: Set Up Withdrawal Whitelists

If your platform offers it, use withdrawal whitelists. This security feature lets you pre-approve wallet addresses for withdrawals.

Even if someone hacks your account, they can’t send your crypto anywhere you haven’t already approved.

Pro Move: Turn this on before your first crypto purchase.

Now you’re ready to buy crypto safely and confidently! In the next section, I’ll share some helpful pro tips for making your first purchase smooth and stress-free.

Pro Tips for Funding Your Account and Making Your First Purchase

So you’ve created your account and verified your identity — now it’s time to fund it and buy crypto. Here are smart tips to help you save money, stay safe, and avoid rookie mistakes.

Best Funding Methods for Low Fees and Speed

- Bank Transfers: Great for large amounts with lower fees, though they can take 1–3 business days.

- Debit/Credit Cards: Super fast but usually come with higher transaction fees.

- Crypto Deposits: If you already own some crypto, transfer it in — often free, just watch for network fees.

Pro Tip: If you plan to buy crypto often, link a bank account for steady, lower-fee transactions.

When to Use Each Method

- Use Bank Transfers for bulk crypto buys to keep fees down.

- Go for Debit/Credit Cards when speed matters or during market dips you don’t want to miss.

- Opt for Crypto Deposits when moving funds between exchanges or wallets.

How to Place a Market or Limit Order

When you’re ready to buy crypto, you’ll choose between two order types:

- Market Order: Instantly buys crypto at the current market price. Best for beginners.

- Limit Order: Sets your price target and waits until the market hits it. Good for patient buyers.

New to this? Start with a small market order to test how everything works.

Watch for Network or Withdrawal Fees

Some platforms charge extra for sending crypto to a personal wallet. Always double-check withdrawal fees before moving your coins.

Pro Tip: Certain times of day have lower network fees, especially on popular blockchains like Ethereum.

Start Small, Test the System

Before making a large purchase, fund your account with a small amount. Place a market order to buy crypto and see how fast and smoothly the transaction goes.

Once you’re confident, you can safely scale up.

Keep Transaction Records

Always save transaction details for your records. Screenshots or email confirmations work fine.

They’ll come in handy for tax reporting and personal security if there’s ever a dispute.

Up next, let’s tackle whether you should buy crypto through a centralized platform or dip your toes into decentralized options — and how to decide what’s best for you.

Bonus: Centralized vs. Decentralized Exchanges — Which Should You Choose?

When you’re ready to buy crypto, one big decision is whether to use a centralized exchange (CEX) or a decentralized exchange (DEX). Let’s break down the difference in simple terms so you can pick the right fit for your experience level.

What Are Centralized Exchanges (CEX)?

Centralized exchanges are platforms like Coinbase, Binance, and Kraken where a company manages your crypto transactions and funds.

Pros:

- Easy for beginners

- Fiat currency deposits (like USD, EUR, or GBP)

- Customer support

- Faster transactions

Cons:

- You’ll need to complete identity verification (KYC)

- The platform holds your crypto, which means potential custody risk

Best for beginners who want a safe, user-friendly way to buy crypto.

What Are Decentralized Exchanges (DEX)?

Decentralized exchanges are peer-to-peer platforms like Uniswap or PancakeSwap where no central authority controls your crypto.

Pros:

- No identity checks or personal details needed

- You control your wallet and private keys

- Huge variety of niche and new tokens

Cons:

- No fiat onramps — you can’t use bank accounts or cards directly

- No customer support if you make a mistake

- Higher learning curve for setting up wallets and managing trades

Best for intermediate users comfortable with self-custody and exploring beyond mainstream tokens.

Which Should You Choose to Buy Crypto?

If you’re a beginner, stick with centralized exchanges to buy crypto. They’re safer, regulated, and offer easy funding options like credit cards and bank transfers.

Once you’re familiar with how transactions and wallets work, intermediate users can start testing DEX platforms for more control and token options.

Pro Tip: Many crypto enthusiasts use both. A CEX for regular buys and a DEX for exploring rare coins and DeFi projects.

Now you’ve got a clear view of your options, it’s time to wrap this up and get you buying your first crypto safely and confidently.

Wonderful post 🙏🎸